AI-Powered Money Market Sweep

Intelligent Cash Investment Automation

AI-Powered Money Market Sweep

Intelligent Cash Investment Automation

Enhance Bank Visibility & Control

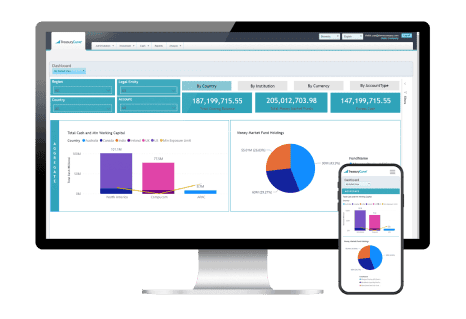

AI Sweep boosts the capabilities of Treasury Curve’s Money Fund Portal. AI Sweep enables organizations to automate the investment of idle cash into a money market fund that has been approved by your organization’s conservative investment guidelines. Diversify deposit risk and potentially earn higher returns on idle cash, while staying in control of your investments.

How AI Sweep Works

Automate Cash Investments

You set the rules for how much you invest and where your money is invested, allowing you to tailor investments to your organization’s specific needs and guidelines. AI Sweep will then automatically invest excess cash into money market funds from some of the world’s most notable providers.

You’re in Control

AI Sweep keeps you in control. You know how much cash you need to pay your bills, to ensure you don’t get a fee for insufficient funds and to qualify for any earnings credits. You pick how to allocate any amount more than that, so your money works for you, instead of sitting idle.

Simple & Secure

AI Sweep is simple to use, streamlining the investment process and reducing manual, repetitive tasks. It even works for redemptions to ensure that disbursement accounts have the required balances to pay bills. As always, your data is kept secure and confidential, but is now being used to your advantage.

Set limits based on what you know, then AI Sweep works for you.

Position your organization to potentially earn higher returns on idle cash, while remaining focused on preservation of principal and liquidity.

AI Sweep Benefits

Position Your Organization to Optimize your Cash & Investments

Invest your excess cash into money market funds you approve, positioning your organization to potentially earn higher returns, while remaining focused on preservation of principal and liquidity.

Save Time

Automate manual, repetitive tasks, freeing up your team to focus on strategic initiatives.

Protect Your Data

Keep your data secure, ensuring it is never exposed to the public domain.

Enhance Decision-Making

Monitor all your cash and investments and effortlessly invest idle cash – all from a single app.

Streamline Compliance & Control

Stay in control of your investments with customizable rules to help ensure you remain in compliance with your organization’s investment policies.

Position your organization to potentially increase returns, improve your liquidity, maintain your focus on preserving principle and save time. Enhance cash visibility, stay in control of your investments, and automate the investment of excess cash securely and efficiently with the Treasury Curve AI Sweep.

Check our Quick Calculator to see if you could be earning more on your cash.

Check our Quick Calculator to see if you could be earning more on your cash.

Receive insights and treasury best practices from the experts.

Sign up for the Monthly Treasury Curve Newsletter

Receive insights and treasury best practices from the experts. Sign up for the Monthly Treasury Curve Newsletter

*Any claims, statements or testimonials may not be representative of the experience of all clients and is no guarantee of future performance or success.

Investments like stocks, bonds, mutual funds and annuities are:

Not FDIC Insured | Not Bank Guaranteed | May Lose Value

Investments in money market funds are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. While money market funds seek to maintain the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. The prospectus is available via the link to the asset manager on the Research page in the column entitled Fund Company URL. The prospectus contains more complete information about each Fund including distribution fees and expenses. An investor should read the prospectus carefully before investing or sending money.

Treasury Brokerage, LLC is a registered broker-dealer and a member FINRA/SIPC.

Securities offered by Treasury Brokerage, LLC a member of FINRA/SIPC. | brokercheck.finra.org

1.877.9TCURVE | info@treasurycurve.com