Treasury Curve Bank Visibility

Unlock the Power of Aggregated Bank Data

Treasury Curve Bank Visibility

Unlock the Power of Aggregated Bank Data

Unmatched Insight & Control

Explore the standout features of Treasury Curve Bank Visibility.

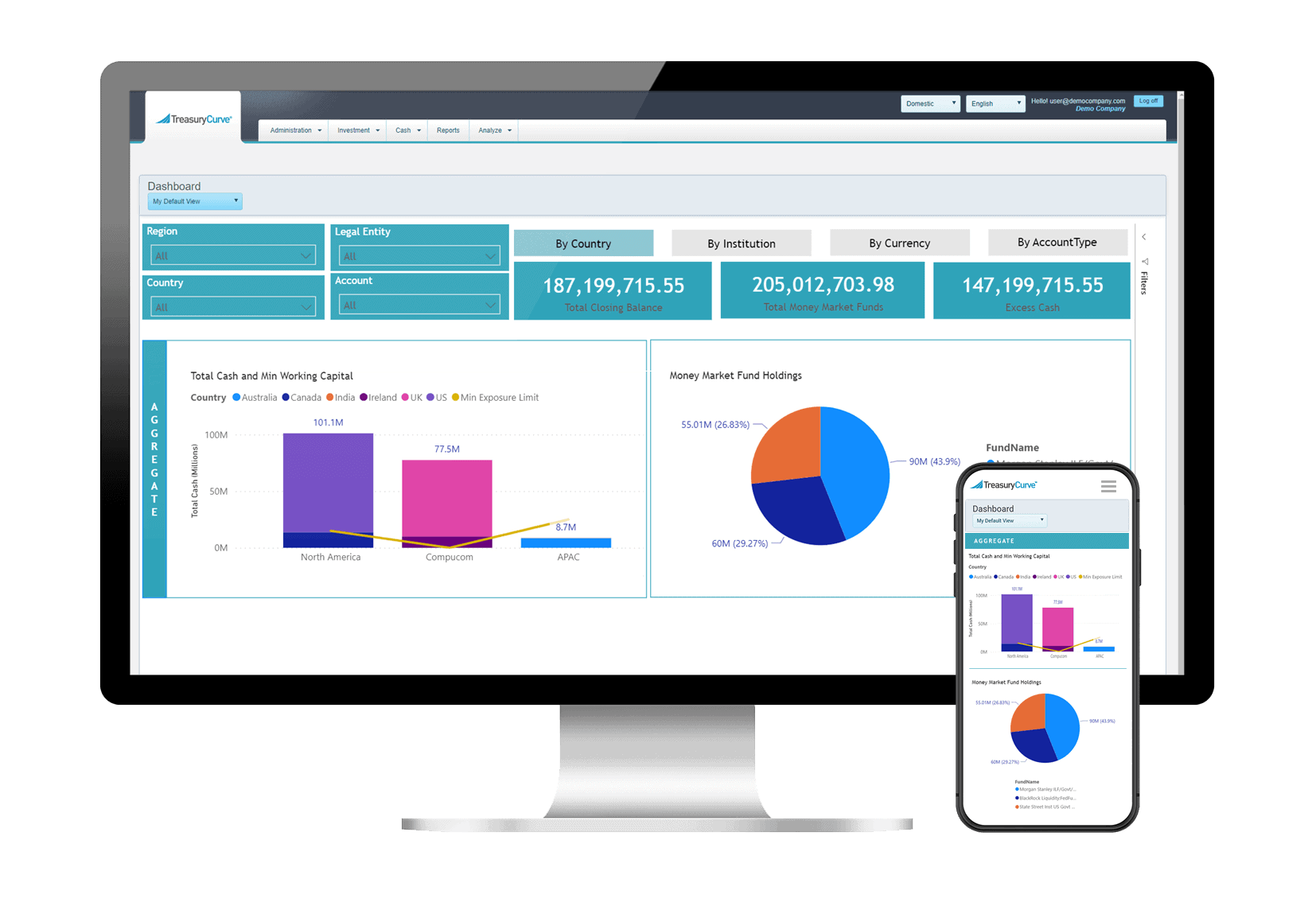

Centralized Visibility

Gain real-time access to all your bank accounts from a single, intuitive dashboard – eliminate the need to log into multiple bank portals. Monitor balances, transaction details, and account activity seamlessly across all your banks.

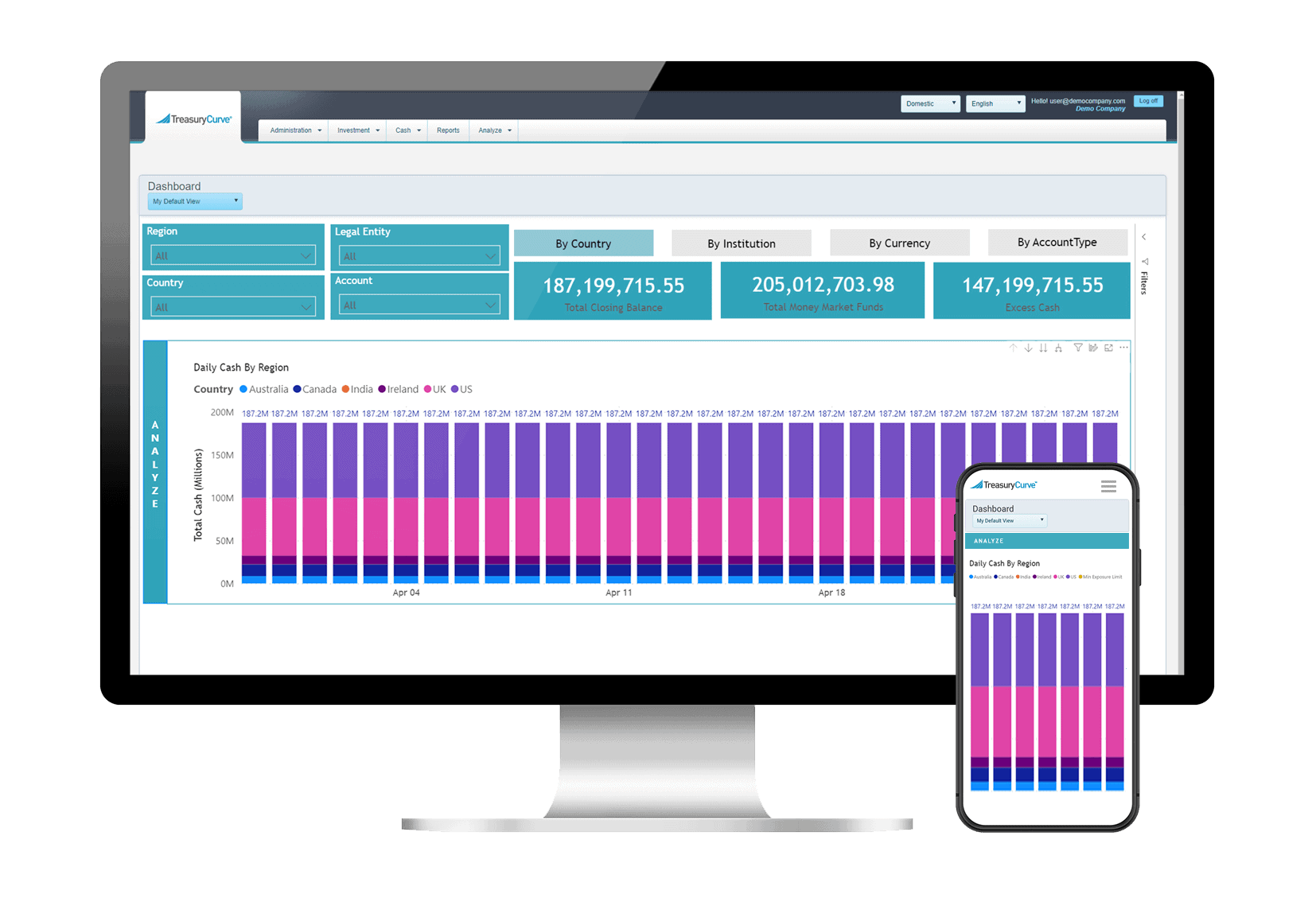

Enhanced Reporting & Analytics

Use our intuitive dashboard to answer key questions about your cash management. Monitor your cash flows, compare available deposit rates and evaluate different options. Select data related to your account, sort it in a way that makes the most sense for your organization, and automatically share it.

Secure Data Access

Benefit from our rigorous security measures, including SOC 1 and SOC 2, Type 2 compliance, to ensure that your account data is protected and controlled.

Transformative Benefits

Discover how Bank Visibility delivers transformative advantages for your financial management.

Improved Financial Visibility

Achieve a clear and consolidated view of your bank accounts, simplifying cash management and enabling better financial planning.

Increased Operational Efficiency

Streamline your treasury operations with automated data integration and reporting, saving time and reducing manual processes.

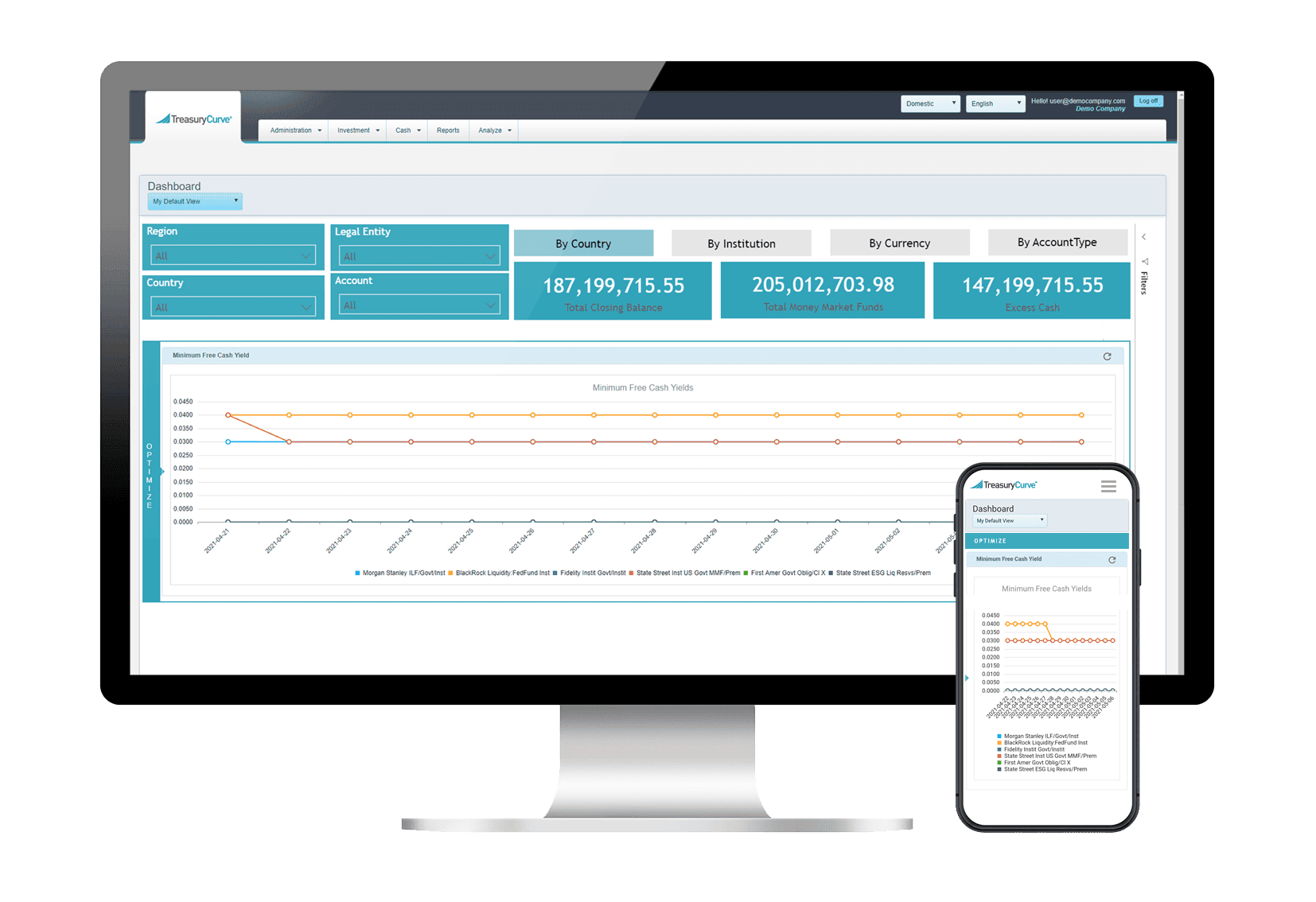

Enhanced Decision-Making

Leverage actionable insights from comprehensive analytics to make informed financial decisions and optimize liquidity management.

Strengthened Security

Trust our robust security protocols to safeguard your financial information and maintain compliance with industry standards.

Reduced Risk

Minimize errors and discrepancies with real-time transaction monitoring and centralized account management, leading to more accurate financial oversight.

Improved Workflow & Compliance

Simplify approvals and audits with the required controls and automation in place.

Receive insights and treasury best practices from the experts.

Sign up for the Monthly Treasury Curve Newsletter

Receive insights and treasury best practices from the experts. Sign up for the Monthly Treasury Curve Newsletter

*Any claims, statements or testimonials may not be representative of the experience of all clients and is no guarantee of future performance or success.

Investments like stocks, bonds, mutual funds and annuities are:

Not FDIC Insured | Not Bank Guaranteed | May Lose Value

Investments in money market funds are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. While money market funds seek to maintain the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. The prospectus is available via the link to the asset manager on the Research page in the column entitled Fund Company URL. The prospectus contains more complete information about each Fund including distribution fees and expenses. An investor should read the prospectus carefully before investing or sending money.

Treasury Brokerage, LLC is a registered broker-dealer and a member FINRA/SIPC.

Securities offered by Treasury Brokerage, LLC a member of FINRA/SIPC. | brokercheck.finra.org

1.877.9TCURVE | info@treasurycurve.com