Strengthening Financial Resilience: How to Drive Incremental Value and Navigate Economic Turbulence with Aggregated Cash and Investment Data

Strengthening Financial Resilience: How to Drive Incremental Value and Navigate Economic Turbulence with Aggregated Cash and Investment Data

In times of economic uncertainty, businesses face a myriad of challenges, from liquidity risk and currency volatility to higher borrowing costs and heightened fraud risk. Traditional treasury approaches, often reliant on spreadsheets and manual processes, fall short in providing the necessary visibility and efficiency.

Enter Treasury Curve

Presented by Chris Kaminski of Treasury Curve and Mark Brousseau from Brousseau & Associates, our latest insights on navigating economic turbulence reveal how aggregating cash and investment data into a single platform can revolutionize your treasury management.

Key Benefits of Data Aggregation

- Streamlined Operations: Consolidate all your financial data for quick and efficient management.

- Enhanced Decision-Making: Gain real-time insights to make informed choices swiftly.

- Better Cash Flow Management: Optimize your liquidity and cash positions.

- Improved Compliance: Ensure regulatory compliance with automated processes.

- Risk Mitigation: Identify and manage risks proactively.

The Treasury Curve Advantage

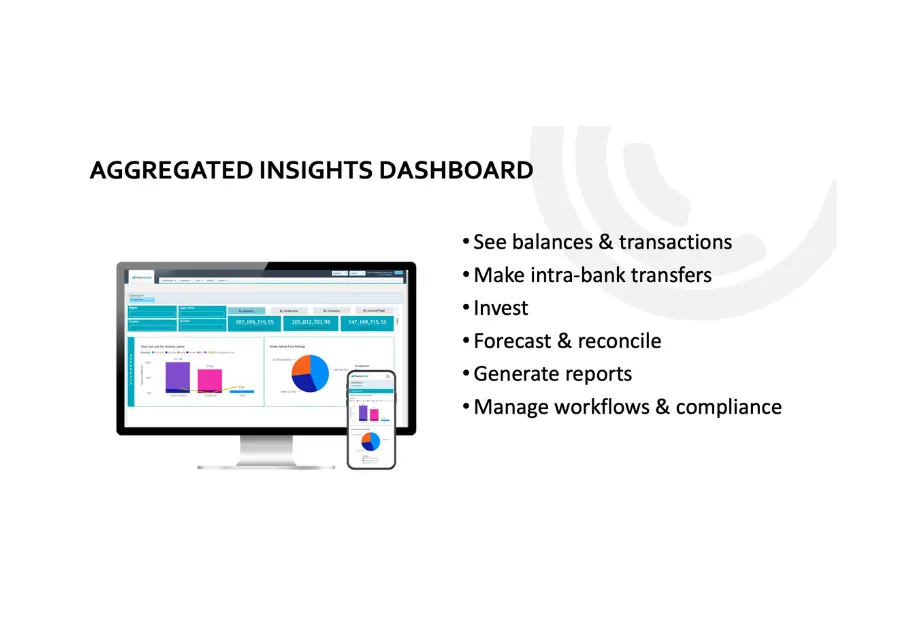

Our aggregated insights dashboard provides a comprehensive view where you can:

- See Balances & Transactions: Monitor all accounts simultaneously.

- Make Intra-Bank Transfers: Simplify transfers without multiple pass-keys.

- Invest Efficiently: Research and execute trades with ease.

- Forecast & Reconcile: Automate cash flow forecasts and reconciliations.

- Generate Reports: Create detailed reports on investments and exposures.

- Manage Workflows & Compliance: Set approval rules and automate controls.

Embracing Advanced Technologies

Finance leaders are increasingly turning to AI-driven insights for enhanced treasury management. Treasury Curve integrates these advanced technologies to offer unparalleled visibility and control.

What to look for

When choosing a treasury solution, consider features like autonomous functionality, data aggregation, integration capabilities, security, user-friendliness, scalability, and total cost of ownership.

To learn more about how Treasury Curve can help your organization navigate economic turbulence, visit our website at www.treasurycurve.com or contact us at info@treasurycurve.com.

Strengthen your financial resilience with Treasury Curve!

Your cash balances may qualify you for our full suite of technology at no cost. Find out now.

*Any claims, statements or testimonials may not be representative of the experience of all clients and is no guarantee of future performance or success.

Investments like stocks, bonds, mutual funds and annuities are:

Not FDIC Insured | Not Bank Guaranteed | May Lose Value

Investments in money market funds are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. While money market funds seek to maintain the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. The prospectus is available via the link to the asset manager on the Research page in the column entitled Fund Company URL. The prospectus contains more complete information about each Fund including distribution fees and expenses. An investor should read the prospectus carefully before investing or sending money.

Treasury Brokerage, LLC is a registered broker-dealer and a member FINRA/SIPC.

Securities offered by Treasury Brokerage, LLC a member of FINRA/SIPC. | brokercheck.finra.org

1.877.9TCURVE | info@treasurycurve.com